Hi

, my name is Jim Rickards.

In the next 60 seconds I’m going to show you a letter I’ve just written to the President.

You see, I’ve spent the last 40 years advising top government officials…

In the late 1990s, for example, I worked with members of the Federal Reserve bank to save America from a $1.3 trillion banking crisis.

It would have imploded the US economy. But thanks to my work, it never happened.

After 9/11, I started working with senior military leaders at the Pentagon and the highest ranks of the CIA.

And helped them develop a financial model to predict the next 9/11… by analyzing unusual activity in airline stocks.

A few years later, in 2007, I delivered a message to the US Treasury.

Warning them the housing collapse was about to get a whole lot worse.

But in all those years…

And despite all those threats to our nation…

I never had to write a letter to the president of the United States…

Until today!

Take a look…

I recently wrote this letter to the President…

Warning him about what I expect to happen on July 1st, 2018…

And I want to share my findings with you today…

Because thanks to this event…

You now have a small retirement window.

If you’re older than 60, the next days will be critical for you…

Take the right steps, and you could secure a comfortable retirement in 2018.

If you do nothing during that small window of opportunity…

I’m afraid you won't be able to retire comfortably.

I know that’s a huge claim…

And that what I’m about to tell you may be hard to believe…

But I’ve built my career predicting events that most people thought were “unthinkable”…

When I predicted the mortgage crisis, for example, nobody believed me either.

In the summer of 2008, I wrote this letter to top advisors in the presidential campaign:

“We can expect another panic spike in October 2008. This financial crisis is not over.”

Unfortunately, everyone in Washington thought such a systemic collapse was impossible.

But three weeks later Lehman Brothers filed for bankruptcy…

Panic took over…

And markets crashed across the globe, wiping out $10.2 trillion of wealth.

Those who ignored my warnings lost everything.

But had you placed one single trade I’ll tell you more about later…

You could have turned a small retirement account of $10,000 into $293,900…*

In a matter of months.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

More recently, I predicted that the UK would vote to leave the European Union (the so-called Brexit).

Nobody believed that could happen.

Once again, those who ignored me were caught completely off guard.

This has all been caught on camera, by the way.

Here’s a short clip you can watch for yourself…

I’d bet 99.9% of investors lost money that day.

But a small group of folks who read my research actually had a chance to make 57% in a matter of days.

Within a year!

Imagine if that happens to you!

For most people, it would take years to see those kinds of gains.

But when you prepare for the “unthinkable,” you can make a fortune in a matter of days… *

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Even if the markets are collapsing and most people are losing money.

Something similar happened when I predicted The President’s victory on live TV.

The so-called experts were giving Hillary a 98% chance of winning right up until election night.

So to say my prediction was controversial is a huge understatement.

You can actually see how my prediction shocked the TV anchors in the 1-minute clip below.

Please, understand…

I’m not telling you all this to brag.

But I want you to realize that there’s another BIG event coming on July 1, 2018…

And depending on what you do…

This event could either help you secure a comfortable retirement once and for all…

Or condemn you to spend your “golden years” struggling to pay for food, medicine and even the most basic necessities.

Again, it all depends on how you act in the next days.

I also think it’s important you realize my predictions are not just “educated” guesses.

They’re based on VERIFIED facts!

Facts that are normally ignored by the “fake news” mainstream media.

The plan you’re about to see, for example, has even been confirmed by members of the global elite.

And I have all the internal “smoking gun” memos to prove it. (You’ll see them in a moment.)

In Short, Come July 1st, 2018… I Fully Expect the Global Elite to Implement a MAJOR Change to the Plumbing of Our Financial System

It’s a brand-new worldwide banking system called Distributed Ledger Technology.

And it will have a huge impact on seniors who are now preparing for retirement…

It will impact your IRA or 401(k)…

Checking and savings account…

And any cash you have parked in the US financial system.

Unfortunately, The President CANNOT stop this.

There will be nothing the White House can do.

They have no direct control over the institutions that will carry this out.

The global elites’ plan is in motion… and my research indicates this new system will be rolled out on July 1.

Once it goes live, here’s what I expect to happen…

***Under the guidance of the government, global elites will use that new financial system to replace the US dollar with their own globalist currency.

But I found a “loophole” that allows you to take a direct stake on this new globalist currency.

And come July 1st, this currency could explode higher… making you a small fortune.

I’ll show you this incredible opportunity in just a moment.

But that’s not all.

***With the globalist currency replacing the dollar, demand for Treasury bonds will dry up… cutting the US government’s main source of funding.

We’ll see major disruptions in welfare programs, such as Social Security and Medicare.

But you won’t have to worry…

Because in just a few minutes I’m going to show you a unique opportunity that could pay YOU $1,000 or more every month…*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Regardless of what happens to Social Security.

And no, this has nothing to do with dividend stocks, bonds, REITs, selling puts or any other income strategy you might have heard before.

***This event coming on July 1st could also set up a huge opportunity in the stock market.

With the new globalist currency replacing the US dollar as the world reserve currency…

And the government struggling to pay its bills, investors will bail out of the stock market…

If you target the right moves, you could walk away wealthier than ever before.

I’m talking about the potential to turn a small retirement account of $10,000

into $293,900… *

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Using a trade opportunity most people don’t even know is possible.

Of course, you won’t hear any of this from the “fake news” mainstream media.

But the government, which is coordinating this entire thing, has even issued a memo.

If You’re Looking for Smoking-Gun Proof, It Doesn’t Get Any Better Than This

The memo clearly states:

“Distributed Ledgers have recently emerged as a key technology supporting multiple applications. The potential exists to transform payments and securities settlement… by offering currency substitutes.”

Look, for years the global elites have been quietly laying the groundwork to replace the US dollar with their own globalist currency.

With this new infrastructure called Distributed Ledgers…

They finally have everything they need to EXECUTE their plan.

I realize most people have never heard of this new global banking system.

But thanks to my network, I’m privy to the details of this plan.

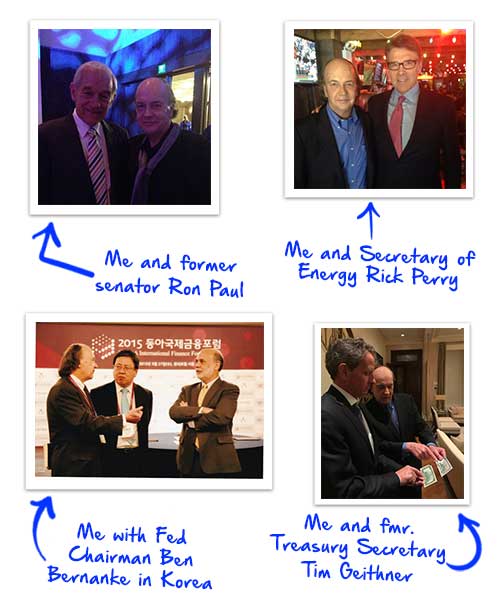

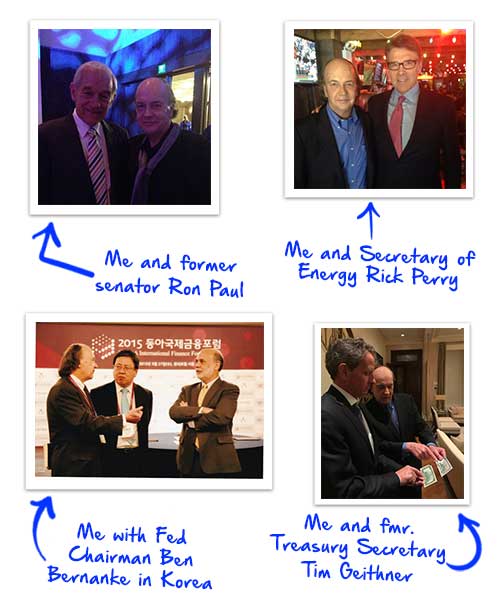

You see, over the last four decades I’ve built an extensive network of who’s who in the financial elite…

From former congressmen, like Ron Paul… to heads of central banks, like Ben Bernanke… to US Treasury officials… foreign ministers… all the way to the White House.

For example, I PERSONALLY know the head of the Distributed Ledger lobbying group.

And thanks to my contacts…

I’ve gathered internal documents that PROVE global elites are preparing to use this new financial system.

The government has even set up a special task force.

And they’ve been meeting behind closed doors to discuss the details.

Here’s a “leaked” photo of their last meeting…

And it’s not just me saying this…

Barbara C., a former US Treasury Department attaché to the European Union, was able to infiltrate one of those internal government discussions…

And she was stunned with what she heard. She said:

“If the world seeks to diversify away from the US dollar, then [Distributed Ledgers] could initiate for the government an entirely different type of construction project.”

Another member of the global elite, Carl T., confirmed that “there’s much anticipation surrounding Distributed Ledger technology.”

Their intentions couldn’t be clearer.

They’ve already laid out the plan…

They’ve set up a special task force…

And now that The President is in power, they’re ready to pull the trigger!

Globalists Are Already Preparing to

Blame All the Chaos on The President

It’s no secret the global elites hate the President.

His nationalistic agenda is the exact opposite of the globalists’ hidden agenda of world government, world money and world taxation.

The President believes in “America first,” not globalism…

He believes in immigration control, not open borders.

He said himself…

“There is no such thing as a global anthem, a global currency or a global flag. This is the United States of America that I’m representing.”

That’s why he already pulled our nation out of the globalists’ international trade deal known as TPP…

And defied global elites by pulling out of their Paris climate accord.

Put simply, The President is a major threat to the global elites’ agenda.

And now they have the perfect plan to stop him.

With Distributed Ledgers, I fully expect them to finally implement their plan to replace the US dollar with their own globalist currency…

The U.K. Independent newspaper published an article saying:

“The great dollar crisis… will follow the banking crisis and the Great Recession — and it will all be sparked by The Donald.”

Even The Wall Street Journal is playing the blame game.

They wrote: “Could the new president bring forward the day the dollar loses its reserve-currency status?”

The Journal actually quoted me in that specific article.

I had to explain to them that global elites are the real threat to America…

NOT The President policies.

As you’re about to see, the global elites have been working on this plan to dethrone the dollar for years.

It just so happens now they have the perfect scapegoat to execute their plan.

It’s Their Chance to END

America’s “Exorbitant Privilege”

You see, many economists thought our massive government debt would trigger a dollar crisis.

But they’ve been proven wrong again, again and again.

Have you noticed that our debt has been exploding for years…

And yet, nothing has happened to the US dollar?

The reason is simple…

The US dollar remains the world’s reserve currency.

That means other nations have to hold and use the US dollar for international trade, instead of their own currencies.

This creates a virtually unlimited demand for US dollars…

And it allows us to print trillions of dollars each year to pay for wars, debt and anything we want.

Basically, it’s a license to print money and abuse the global system.

And that’s why we’ve been able to accumulate more than $19 trillion in debt without suffering any consequences.

As long as there’s no alternative to the US dollar, we can keep doing that forever.

Look, our nation had an amazing run with the US dollar as the #1 reserve currency.

Because of it, we have the world’s best technology…

The word’s most influential culture…

The world’s most powerful military…

We were able to build a true empire with seemingly unlimited control of the world.

But that’s precisely why global elites are sick of the US dollar.

How do you think the other 190+ nations feel about the fact we can print a $100 bill anytime we want…

While they actually have to pony up $100 of actual goods in order to obtain the same bill?

Global elites are sick of what has been called America’s “exorbitant privilege.”

And now they’re finally taking action to “fix” this problem.

For years, they’ve been working on a plan to replace the US dollar with their own globalist currency.

What’s different this time is… they finally have the tool they need to execute their plan.

Let me prove it to you…

My Predictions on the Globalist

Currency Have Been Confirmed

Over the last couple of years I’ve been all over TV… from Fox News to CNBC, CNN and Bloomberg…

Telling Americans that the financial global elite was planning to issue their own globalist currency called SDRs.

And that they would use this new currency to REPLACE the US dollar as the global reserve currency.

I’ve even written about this extensively in my best-selling books The Road to Ruin and The New Case for Gold.

I’m sure some people in the mainstream media thought I was crazy…

But the United Nations and the government have both CONFIRMED this plan to replace the US dollar is real.

The UN said we need “a new global reserve system… that no longer relies on the United States dollar as the single major reserve currency.”

And the government admitted they want to make “the special drawing right (SDR) the principal reserve asset in the [International Monetary System].”

More recently, they advanced their plan by helping private institutions, such as the UK’s Standard Chartered Bank, issue bonds in SDRs.

Although our mainstream media ignored this major event, the UK media reported:

This is all happening.

And once Distributed Ledgers go live on July 1st, 2018…

This trend will accelerate…

And many other nations will be able to dump the US dollar for SDRs.

Look, you don’t need to be an economist to connect the dots here.

But let me sum it all up for you…

Fact #1 — The government issues a globalist currency called SDRs.

Fact #2 — The government has confirmed they want to replace the US dollar with SDRs.

Fact #3 — The government has confirmed Distributed Ledgers can be used for “currency substitution”… and they’ve even set up a special task force.

Why do you think they’re so interested in Distributed Ledgers?

The government wouldn't be looking at this technology to create a dollar payment system.

They'd be looking at it to create an SDR payment system, because that's the currency they issue.

Remember this picture of the task force I showed you earlier? Take a look again…

See that woman at the center?

That’s Christine Lagarde, head of the government.

When asked about the task force, she said:

“As I see it, all this amounts to a brave new world for the financial sector.”

Yes, a brave new world where the dollar is no longer the world reserve currency.

Barbara C., a former US Treasury Department attaché to the European Union, has reached the same conclusion.

She said the link between the globalists’ currency and Distributed Ledgers “is impossible to avoid.”

And that “the government seems to be exploring the possibility of permitting a broader use of [their globalist currency] beyond internal transactions among member central banks.”

Make no mistake…

The government is planning to use Distributed Ledgers to replace the US dollar with SDRs.

And just to be clear…

SDRs will NOT be available to everyday folks like you.

It’s not something you can have in your wallet.

Instead, you’ll be left with devalued dollars.

But I found a “loophole” that allows you to take a stake in this exciting new currency.

Just remember, you must act before July 1, 2018…

Because Once This Plan Goes Live… Your Retirement Window Will Slam Shut Forever

That means if you’re older than 60, you only have a few days to prepare.

Once this plan goes live, I’m afraid you’ll no longer be able to retire comfortably.

You see, once other nations start accumulating the globalist currency through Distributed Ledgers…

They will no longer need to hold dollars.

And that will have a DIRECT impact on welfare programs, such as Social Security and Medicare.

When we buy things from other nations, like textiles, electronics, etc…

We pay them in US dollars.

And what do they do with that money?

They can’t use it in their own economies. So most of them invest in Treasury bonds.

And that’s exactly how our government finances its operations…

By issuing Treasury bonds to other nations.

Once Distributed Ledgers go live, other nations will no longer need to buy Treasury bonds.

And that means our government will no longer be able to finance its normal operations, including welfare programs.

I showed you how some private banks have already started to issue SDR bonds.

That process will accelerate once Distributed Ledgers go live…

With many other nations dumping US Treasury bonds in exchange for SDR bonds…

Essentially cutting the funding of the US government…

And YOUR Social Security and Medicare.

That’s why this new financial system could have a HUGE impact on seniors who depend on Social Security income to live.

Imagine watching your Social Security check getting cut from $2,000 to $1,000!

But don’t worry…

In just a moment, I’ll show you a unique way of getting $1,000 or more a month with this special opportunity…*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

But That’s Not the Only Looming

Opportunity... Here’s an Easy Way to Turn $10,000 Into $293,900*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

If you have your retirement account parked in stocks, you could watch it evaporate in a matter of days…

Because the weakest companies in the stock market could collapse once this plan goes live.

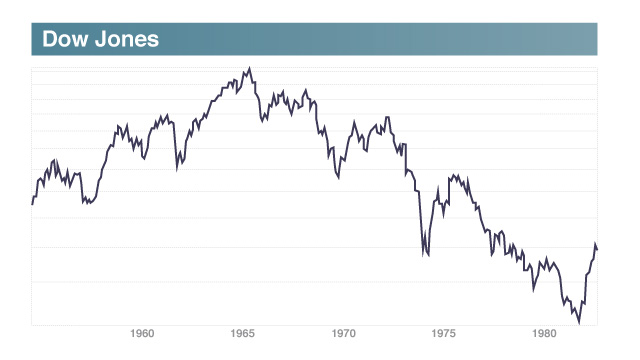

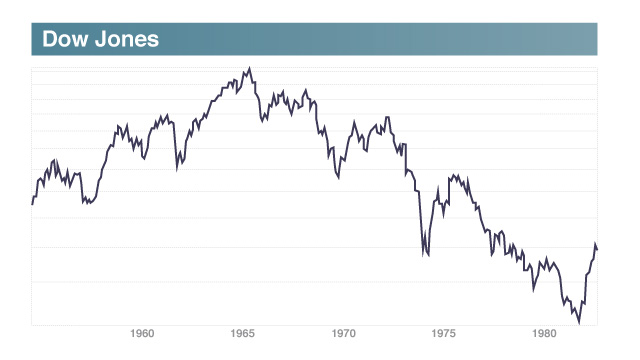

Just look what happened the last time we had a big change in our global financial system.

In 1971 Nixon announced the US would no longer officially trade dollars for gold.

That created a lot of uncertainties, turning that decade into a nightmare for stock investors.

Take a look… the Dow Jones, an index of “stable” blue chip stocks (the kind most retirees like to hold), was cut in half!

Stock investors bailed out of the market and, for the most part, didn't come back for a decade.

I expect something similar once Distributed Ledgers go live.

Because the transition from a US dollar system to a new system dominated by SDRs will be messy.

Stocks will collapse… and will stay down.

There will be no recovery this time.

Because the US government won’t be able to come to the rescue, like they did in 2008.

They won’t even have funding for normal operations…

Let alone to save stock investors.

But don’t worry.

If you target the weakest companies out there, you could come out on the other side wealthier than ever.

In just a moment, I’m going to lay out a 3-step plan to help you secure a comfortable retirement.

With this plan, you’ll be able to…

- Be one of the few Americans with a stake in the new world reserve currency, the SDR

- Collect an extra $1,000 or more a month, no matter what happens to Social Security*

- And make as much as $293,000 during the next stock market crash*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

But before we get to those solutions…

Let me explain exactly how Distributed Ledgers work…

The Government-Led Currency Coup… Revealed

As I mentioned before, most international financial transactions are conducted in the US dollar...

And that means they must pass through the US banking system’s network.

This gives the US government an incredible amount of power.

They can not only see all the transactions, but stop, trace or freeze them.

For example, in 2014 the Obama administration fined French bank BNP Paribas $9 billion because they did business with Cuba and Iran.

The bank didn’t break any French laws.

But the US government threatened to kick them out of the US banking system if they didn’t pay the fee.

Since the US dollar plays such a key role in international trade…

Being kicked out of the US banking system is like a death sentence.

As long as the US dollar remains the world’s dominant reserve currency…

International financial institutions must be able to clear and settle US dollar transactions if they want to remain in business.

That’s why French bank BNP Paribas paid the fee.

Something similar happened with Britain’s Standard Chartered Bank, Germany’s Commerzbank and Switzerland’s UBS, among others.

But what if global elites could set up another network beyond the reach of the US government…

And What if Other Countries Could

Use That Network to Settle Their Transactions in SDRs, Instead of the US Dollar?

That’s exactly what Distributed Ledger technology is all about.

It’s a new financial technology to clear and settle international financial transactions.

With this distributed system, America will no longer have a stranglehold over the world’s international finance system.

It allows foreign banks and other institutions to conduct transactions in SDRs instead of dollars…

And transfer funds across international borders without using America’s payment system.

You see, for years the government has been planning to replace the US dollar with SDRs…

But they didn’t have the infrastructure necessary to make that happen.

They didn’t have a decentralized payment system that could facilitate wide adoption of SDRs.

Now they do!

With a Distributed Ledger, it will be much easier for other nations to dump the US dollar and replace it with SDRs.

Since this is an untraceable, encrypted ledger…

Countries like China and Russia will be able to invest in SDR bonds… and the US government will never know.

It’s totally outside America’s control.

And because it’s a Distributed Ledger, there’s no choke point we can control.

That means we can’t stop it.

Remember, this is all part of the global elites’ agenda of world government, world money, and world taxation.

They’re going for the jugular…

Because they know replacing the US dollar with their globalist currency is the ultimate way to transfer power from the US to the global elites.

Don’t get me wrong…

Your dollars in your wallet or bank account won’t disappear from circulation.

When global elites make that switch…

That new globalist currency will NOT trickle down to you and me.

It will remain at the top of the system, in the vaults of central banks, monetary agencies and global corporations.

You won’t have SDRs in your wallet.

Instead, we'll be left with near worthless dollars for everyday transactions.

The dollar will become just a local currency… no different than the Mexican peso.

Just like Mexican pesos are good only in Mexico…

The US dollar will be good only in America.

They won’t be good anywhere else because other nations will NOT need them.

Since they will be using SDRs instead.

Like I mentioned earlier, retirees on fixed incomes will be hit the hardest…

Because we’ll see major disruptions in welfare programs like Social Security and Medicare.

Most seniors will end up on the breadlines…

But there’s no reason you have to join them.

If you take the 3 steps I outline below before July 1, you can watch your portfolio soar…*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Even when almost everyone else’s is crashing around you.

STEP ONE:

The Only Way I Know of Investing in

the Globalist Currency

Betting on currencies during political events is one of the quickest ways to make a fortune.

For example, when the UK voted to leave the European Union (the so-called Brexit)…

Investors who bet against the British pound made a fortune.

Crispin O., a hedge fund tycoon, made more than $268 million.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Something similar happened when the Swiss government decided to devalue its currency…

Thomas S., another hedge fund manager, pocketed $120 million in one day.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

And, of course, we’ve all heard of George Soros’ legendary trade betting against the pound in the 1990s…

He made a cool $1 billion in one day.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

But here’s the thing…

All those trades were practically off limits to everyday folks like you and me…

For two reasons…

First, they required complicated transactions in the forex market.

And second, they were extremely hard to predict.

Which is why I’m so excited with today’s opportunity.

I found a “loophole” that allows you to own an “unofficial” stake in the future world reserve currency.

It’s 100% legal…

It doesn’t require you to open a forex account…

And it doesn’t require a lot of money to get started.

That means anyone can open this trade.

Plus, unlike those situations I described above…

This trade is totally predictable.

Because I fully expect this plan to go live on July 1, 2018.

As I said, once a Distributed Ledger goes live…

The globalist currency will NOT trickle down to everyday folks like you and me.

It will stay at the top… and it will be exclusive to the financial elite ONLY.

And yet, once this new currency takes over as the world’s top form of reserve cash…

The few who have access to it could make an incredible fortune.

And I happen to have the only private link in the world that will get you in.

You’ll find this link inside a private intelligence dossier called The Only Way to Own the New World Money.

I’d like to send you a copy, free of charge.

Inside it shows you exactly how this works.

It couldn’t be easier.

It’s a little-known kind of account that gives you an advance stake in the rise of “new money” bank reserves.

And it’s the only way I know of for any private citizen to get access to the globalist currency.

And you can do it right now… before a Distributed Ledger goes live.

I recommend you get in as soon as possible…

Because I’m afraid after July 1st, it will be too late.

Members of the global elite will pile up in this new currency, pushing its price way higher.

The time to get in is now.

All you need is the private web link that gets you started.

Only a tiny number of people in the world happen to have it. I’m one of them.

I’d like to share it with you today…

I don’t get a commission or anything for sharing it with you. Even still, I’ll show you exactly how to set up this special “world money” account, for maximum exposure to any gains.

After that, you can rebalance your assets in this account however and whenever you see fit. There are no money managers involved.

You’ll have complete control of this special account.

And I’ll have the complete satisfaction of knowing you’re ready to preserve your wealth — and possibly collect a fat double-digit return — ahead of the “world money” deadline.

It’s that simple.

Because every American citizen deserves to get a piece of what could be a really explosive currency move.

I’ll give this private link to you… and explain how to use it… in your free copy of this intelligence dossier, The Only Way to Own the New World Money.

STEP TWO:

How to Turn a Small Retirement Account

of $10,000 Into a $293,900 Fortune…*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

While most authorities were oblivious to the train wreck in 2008...

I saw the collapse coming a mile away.

In a 2005 presentation at Northwestern University’s Kellogg School, I warned the audience a new financial catastrophe was coming.

In late 2007, I told a US Treasury official that what we were watching at the time was just the beginning of a systemic collapse.

In the summer of 2008, I sent a letter to Congressmen warning them to prepare for a “panic spike in October 2008.”

Unfortunately, three weeks later I was proven right.

While most investors lost everything, it didn’t have to be that way.

Because if you had placed one single trade, you could have actually walked away with a small fortune.

See, in a crash there are always two sides…

The victims who do nothing and lose everything.

And the vultures who see what’s coming, and use the crash to profit.

In the next market crash, I want you to be a vulture, like me…

In my own career, I’ve used this system to pocket gains as high as 3,000% when shares of telecommunications giant WorldCom collapsed.

You can do the same by targeting the weakest companies in the market.

Let me prove it to you…

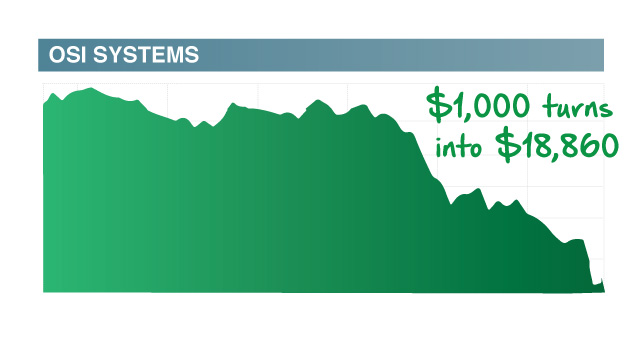

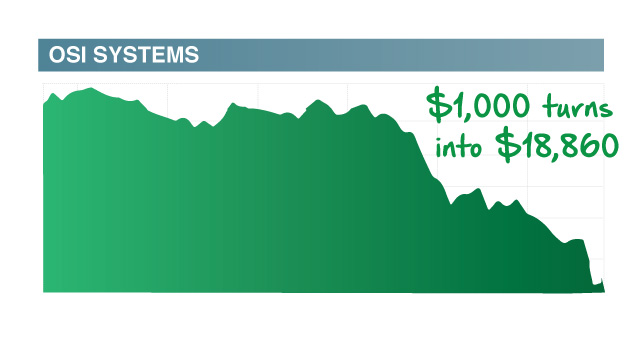

Take a look at what happened with company OSI Systems in 2008.

It lost more than half of its value in a little more than two months.

Had you placed one simple trade, you could have turned that crash into a 1,786% gain.*

That’s more than 17 times your money…*

Enough to turn $1,000 into $18,860.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

All in a little more than two months.

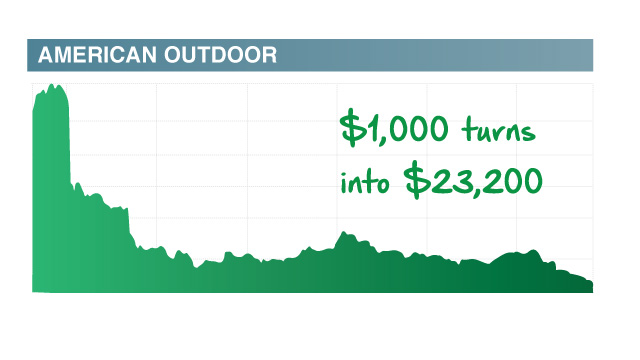

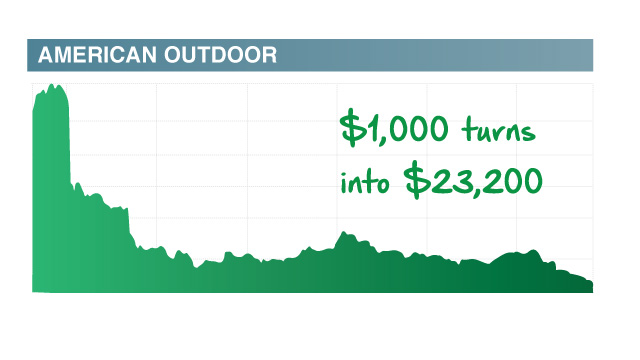

Or look at American Outdoor Brands Corp.

Its investors were ruined when shares crashed 86% in 2008.

But with one simple trade, you could have turned $1,000 into $23,200.*

Invest $5,000, and now you’re looking at a payout of $116,000!*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

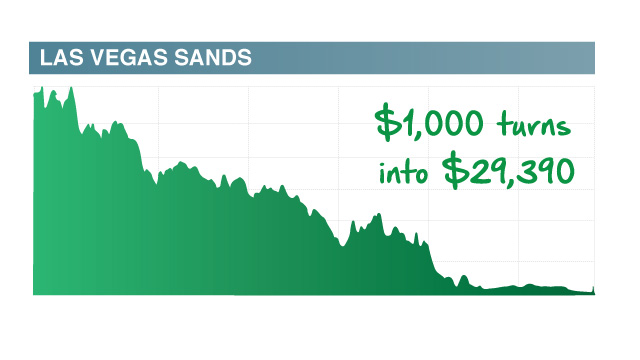

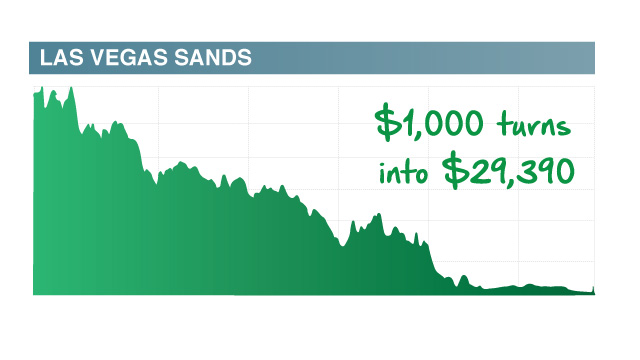

Or look at giant casino operator Las Vegas Sands.

In 2007 the clueless mainstream media thought the company had “seemingly unlimited growth prospects in Macau, the most lucrative gambling market in the world.”

Shares were trading at nearly $150 at the time.

But with all the turmoil in 2008, shares dropped all the way to $1.50.

A crash of 99%!

The company almost went bankrupt.

But had you placed one simple trade during that bloodbath…

You could have made an incredible 2,839% gain…*

Enough to turn $1,000 into $29,390…*

$5,000 into $146,950…*

And $10,000 into $293,900!*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Can you see now how easy this can be?

Targeting weak companies during a crash is the quickest and most predictable way of making a fortune.

And to help you get started, my team and I have already done all the homework for you.

We’ve identified three companies you can target right now by placing a simple trade.

You’ll find all the details on how to profit from these three companies inside your FREE report How to Turn $10,000 Into a $181,000 Fortune.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

STEP THREE:

How to Get as Much as $1,000 or More…

Every Month… Regardless of What Happens

to Social Security*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

As I mentioned before, once the global elites’ plan goes live, it could have a huge impact on American seniors.

I fully expect to see major disruptions in the Social Security program.

Which is why it’s important you find other sources of income.

Those who rely exclusively on Social Security will almost certainly end up on the breadlines.

But don’t worry.

You won’t have to be one of them.

Because I’ve found a unique way you could generate as much as $1,000 or more every month… almost effortlessly.

That might not sound like a lot…

But wouldn’t you like to have $1,000 deposited into your account every month?*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

Even better…

You can get started with as little as $5.50… with a click of a mouse.

And no, this is not a dividend-paying stock… not bonds… not selling puts… not rental income…

Or any other income strategy you might have heard before.

Even though most people have never heard of this opportunity…

It couldn’t be easier.

Because you can get started directly from your retirement account.

And once you “sign up,” you’ll watch that cash get deposited in your account every month.

That means just a few days from now…

You could be getting $1,000 or more deposited into your account.*

I’ve put all the details inside another intelligence report called How to Get $1,000 or More a Month… Regardless of What Happens to Social Security.*

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

It’s yours FREE.

Just keep in mind there is no such thing as a risk-free investment. And that past performance is no guarantee of future return.

Altogether that gives you three powerful ways to protect yourself.

You’re getting a way to profit from the new world reserve currency…

To make as much as $293,900 by targeting the weakest companies in the market…*

And the chance to get $1,000 every month, regardless of what happens to Social Security.*

And all before the July 1st deadline.

That’s a lot of my best research.

*The examples provided may not be representative of typical results. Your capital is at risk when you invest in securities – you can lose some or all of your money. Never risk more than you can afford to lose.

And With Your Permission, I’ll Send You a Free Copy of Everything I’ve Mentioned So Far

That’s right…

I’m offering to give it to you right now.

No questions asked and yours to keep.

You see, even though I constantly appear on everything from CNBC to Fox and CNN…

Those venues don’t allow me to share the most sensitive moneymaking moves with regular folks like you.

And that’s important, because today we have a very urgent situation…

After July 1st, 2018, I’m afraid those who don’t prepare will never be able to retire comfortably.

The retirement window will slam shut forever.

With that in mind, I’d like to help you navigate what’s coming…

And guide you on an ongoing basis as this new plan is implemented…

Recommending to you where to invest and how to avoid the pitfalls.

That’s why I’m inviting you to take a risk-free trial of Jim Rickards’ Strategic Intelligence.

My mission in this monthly research is simple…

To help everyday folks profit from “unthinkable” events and financial crisis.

Until now, I have only provided this kind of service to my high-net-worth clients and members of the US intelligence community.

But with Rickards’ Strategic Intelligence, you too will have the opportunity to hear my best ideas on an ongoing basis.

And it’s important to note, this will be the exclusive place to receive my monthly issues and alerts.

This letter will not be available anywhere else in the world, at any price.

Once you agree to a risk-free trial of this exclusive new letter…

I’ll send you everything I mentioned today.

As soon as you claim this package, you’ll also gain access to my Strategic Intelligence Video Series.

It’s a 10-part welcome series of videos where I answer all the questions you need to know to get up to speed.

Think of it like a “fast track” introduction course you can watch even before you start reading my letter and intelligence reports.

With all this material, I’m confident you’ll be able to protect and grow your wealth in the coming years…

No matter what happens with our economy.

But don't take my word for it.